Roth ira penalty calculator

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Open An IRA In As Little As 10 Minutes.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

For instance if you converted your.

. As with contributions the five-year rule for Roth conversions uses tax years but the conversion must occur by Dec. Use this calculator to estimate your ability to retire early via a multiyear roth ladder strategy. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

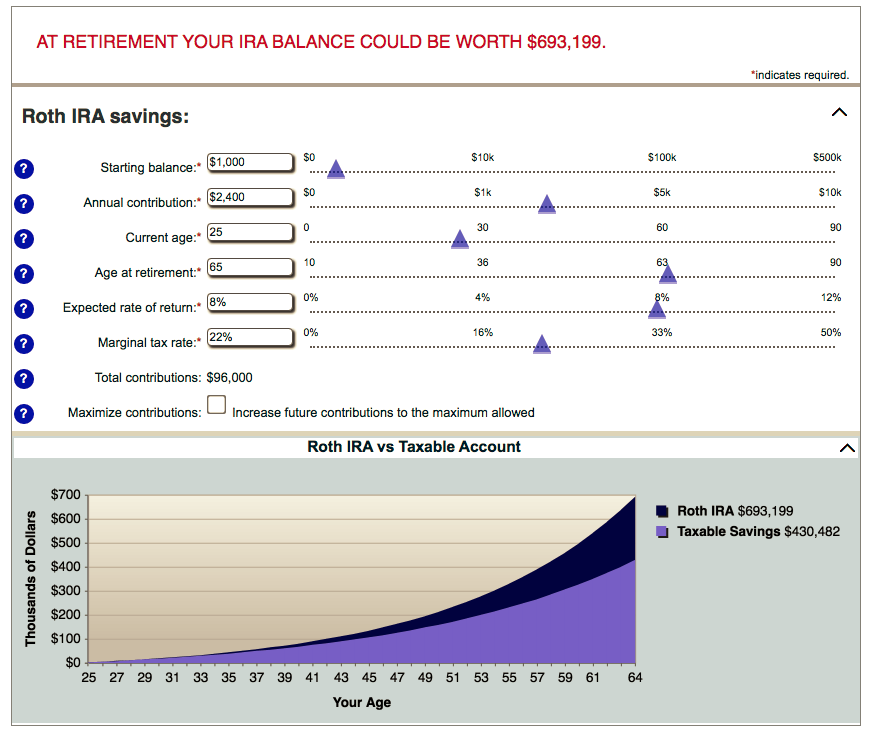

In some situations an early withdrawal may also be subject to income tax or a. Simply take the entire amount of your early withdrawal and multiply by. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

This condition is satisfied if five years have passed. If you withdraw money from your. Presuming youre not around to retire next year you desire growth and concentrated investments for your Roth IRA.

This calculator assumes that you make your contribution at the beginning of each year. For 2022 the Roth IRA income limits for a full IRA contribution is 125000 for singles and heads of household 204000 for married couples filing jointly and 10000 for. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

You cannot deduct contributions to a Roth IRA. This allows you to tap into your retirement accounts without penalty before reaching age 59½. Not everyone is eligible to contribute this.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. For some investors this could prove to. For 2022 the maximum annual IRA.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. Start planning ahead for next year by checking out 2017 Roth IRA contribution. 31 of the calendar year.

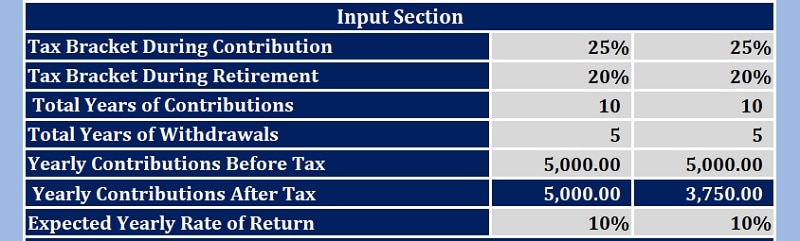

This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your Traditional IRA to a Roth IRA. The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Ad 247 Access To Schwab Professionals Resources. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Unlike taxable investment accounts you cant put an. However a 10 early withdrawal penalty applies with a few exceptions if you withdraw or use IRA assets before age 59½.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. With a traditional IRA in which you made tax-deductible contributions the calculation is easier.

Multiply your earnings from your Roth IRA. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. Read 5 Reasons Why I Love My Roth IRA our part in the Good Financial Cents Roth IRA Movement.

Reviews Trusted by Over 45000000. Roth IRA Early Withdrawal Tax Calculator. Simply put you intend to invest in stocks.

First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. If you satisfy the. The amount you will contribute to your Roth IRA each year.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. Compare 2022s Best Gold IRAs from Top Providers. Roth IRA Penalty Calculator.

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Roth Ira Contribution

How To Use A Roth Ira Calculator Ready To Roth

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Retirement Withdrawal Calculator For Excel